Can we really time the stock market to our benefit?

- Art Of Wealth Creation

- Mar 6, 2018

- 1 min read

Common wisdom today tells us that timing the market doesn’t work.However, some investors can still profit from timing the market in a smaller, more reactionary way!

What Is Timing the Market?

Timing the market is an investment strategy where investors buy and sell stocks based on expected price fluctuations(rather than on market noise/news fluctuations). If investors can correctly predict when the market will go up and down, depending on the indepth research and analysis, they can make corresponding investments to turn that market move into profit.

Example : If an investor expects the market to move up on economic news next week, that investor might want to buy mutual funds or stocks that he or she expects to go up, leading to a profit.

Taking Advantage of Small Market Dips

Major political events, economic announcements, and mergers and acquisitions activity can all lead to market overreactions. They often behave just like Brexit, indian market crash of 2008, 2011, 2013, 2016 etc which offer astute investors an opening for a profitable series of trades.

If you time it right, you can walk away from a market timed trade with a fat profit, but in some cases, you will end up holding a loss. If you invest well and limit your exposure, earning small profits from ebbs and flows in the market is a possible route to investment success.

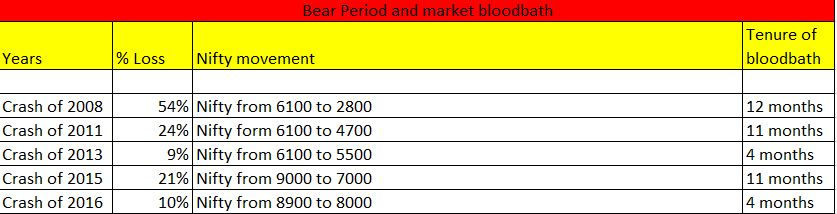

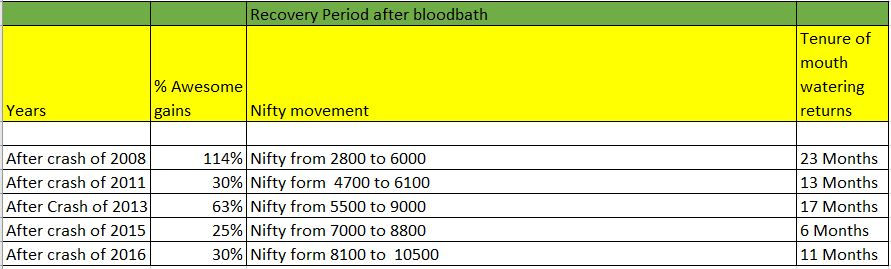

I have conducted some detailed statistical analysis as shown below and all the four cases detailed below majorly showcase that every bloodbath if followed by a major profit period where primarily investors make money.

Buying Opportunity:

Made money because bought right stuff at right time:

Don't sit back, instead take the right step for your bright financial future!

Comments